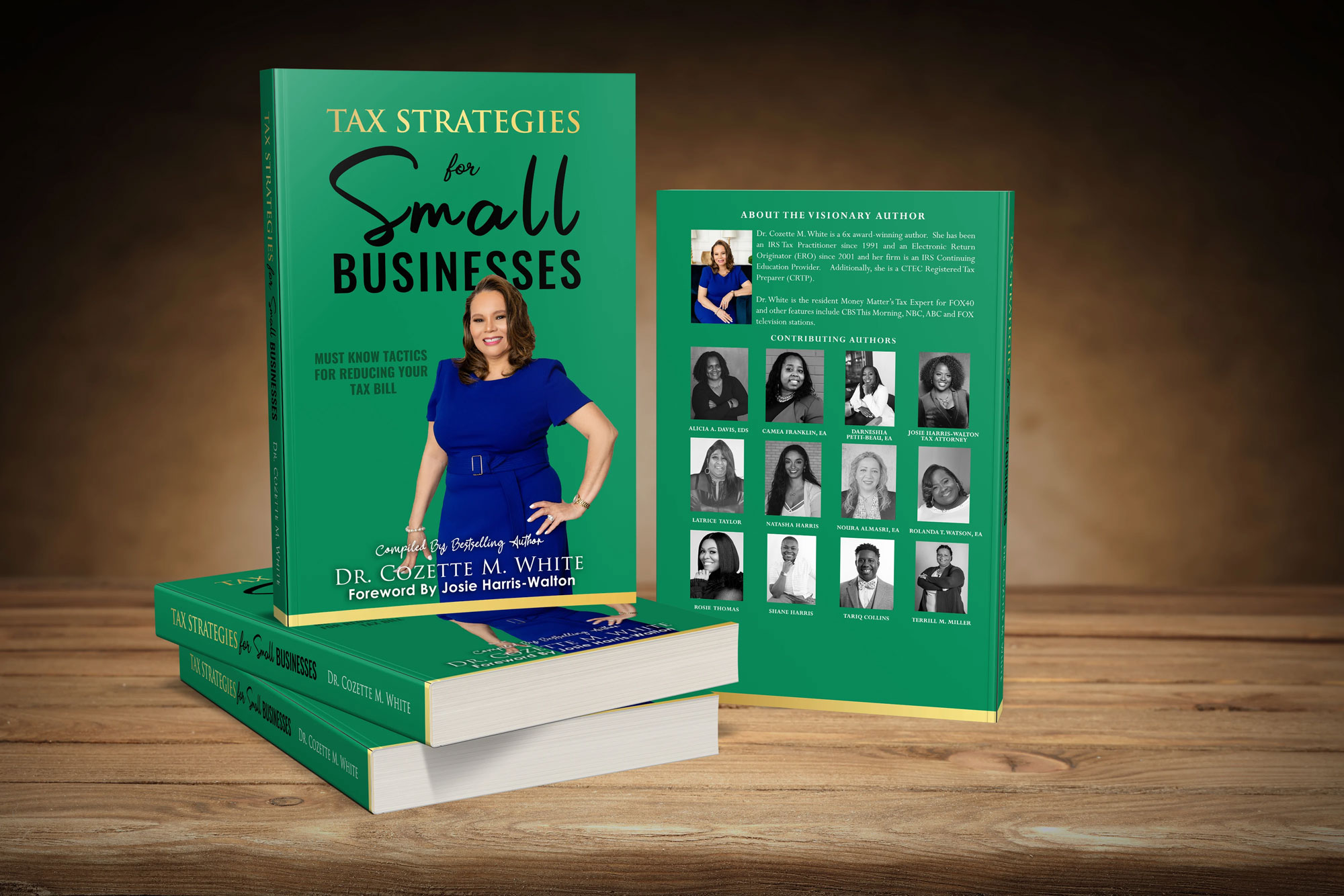

TAX STRATEGIES FOR SMALL BUSINESSES

Understand taxes within no time!

Understanding tax rules, regulations, and strategies are important for anyone who has a business. Irrespective of whether it is a small or large business, taxes are crucial. This book will help small business owners increase profits while feeling more comfortable dealing with taxes. We begin by looking at the often-overlooked critical decision small business owners face when they start a business: the choice of business entity.

In this book, you will discover:

- The different types of business formations

- Importance of reconciling your records

- Cash Flow Management Strategies

- Benefits of S-Corporation

- Retirement & Retirement Planning

- Taxation mistakes to avoid

- Managing an audit

- Applicable deductions for small businesses

- Practical tax-saving tips

- Helpful applications for taxes, and much more.

Message from Dr. Cozette M. White

On behalf of each collaborator, we want to say “Thank You” for your support! We hope you enjoy the book.